[ad_1]

Ho-Yin Mak, Georgetown College; Christopher S. Tang, College of California, Los Angeles, and Tinglong Dai, Johns Hopkins College

Two electrifying strikes in latest weeks have the potential to ignite electrical automobile demand in america. First, Congress handed the Inflation Discount Act, increasing federal tax rebates for EV purchases. Then California accepted guidelines to ban the sale of latest gasoline-powered vehicles by 2035.

The Inflation Discount Act extends the Obama-era EV tax credit score of as much as US$7,500. But it surely consists of some excessive hurdles. Its country-of-origin guidelines require that EVs – and an rising proportion of their parts and demanding minerals – be sourced from the U.S. or nations which have free-trade agreements with the U.S. The legislation expressly forbids tax credit for autos with any parts or crucial minerals sourced from a “international entity of concern,” corresponding to China or Russia.

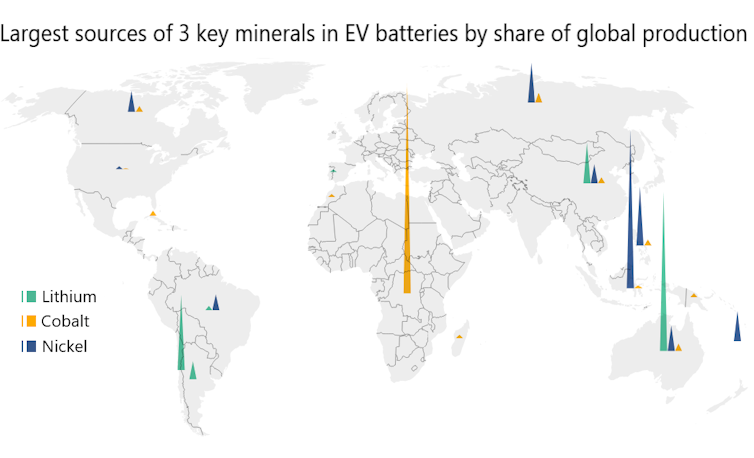

That’s not so easy when China controls 60% of the world’s lithium mining, 77% of battery cell capability and 60% of battery part manufacturing. Many American EV makers, together with Tesla, rely closely on battery supplies from China.

The U.S. wants a nationwide technique to construct an EV ecosystem if it hopes to catch up. As specialists in provide chain administration, we have now some concepts.

Why the EV business relies upon closely on China

How did the U.S. fall thus far behind?

Again in 2009, the Obama administration pledged $2.4 billion to assist the nation’s fledgling EV business. However demand grew slowly, and battery producers corresponding to A123 Methods and Ener1 didn’t scale up their manufacturing. Each succumbed to monetary stress and had been acquired by Chinese language and Russian traders.

China took the lead within the EV market by an aggressive mixture of carrots and sticks. Its shopper subsidies raised demand at house, and Beijing and different main cities set licensing quotas mandating a minimal share of EV gross sales.

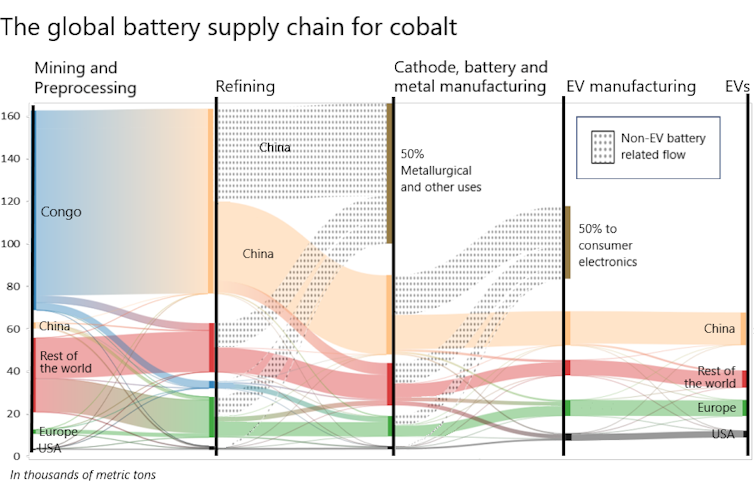

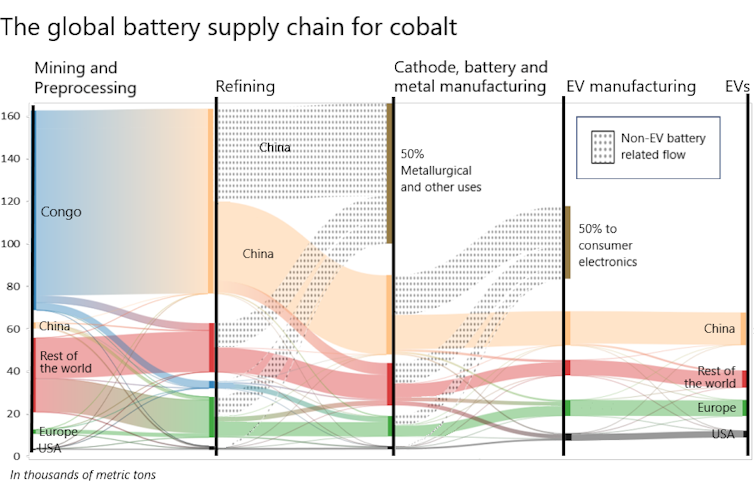

China additionally established a world-dominating battery provide chain by securing abroad mineral provides and closely subsidizing its battery producers.

In the present day, the U.S. home EV provide chain is much from satisfactory to satisfy its objectives. The brand new U.S. tax credit are designed to assist flip that round, however constructing a resilient EV provide chain will inevitably entail competing with China for restricted sources.

A complete nationwide technique entails measures for the brief, medium and long run.

Quick-term: What might be achieved now?

Six of the ten best-selling EV fashions in 2022 are already assembled within the U.S., fulfilling the Inflation Discount Act’s last meeting location clause. The Hyundai-Kia alliance, which has three of the opposite 4 bestsellers, plans to open an EV meeting line in Georgia. Volkswagen has additionally began assembling its ID.4 electrical SUV in Tennessee.

The problem is batteries. In addition to the Tesla-Panasonic factories in Nevada and deliberate in Kansas, U.S.-based battery producers path their Chinese language counterparts in each dimension and progress.

For the U.S. to scale up its personal manufacturing, it must depend on strategic companions abroad. The Inflation Discount Act permits imports of crucial minerals from nations with free commerce agreements to nonetheless qualify for incentives, however not imports of battery parts. This implies abroad suppliers like Korea’s “Massive Three” – LG Chem, SK Innovation and Samsung SDI – which provide 26% of the world’s EV batteries, are shut out, despite the fact that the U.S. and Korea have a free commerce settlement.

The Korea Car Producers Affiliation has requested Congress to make an exception for Korean-made EVs and batteries.

Within the spirit of “friend-shoring,” the Biden administration might consider a brief waiver as a stopgap measure that makes it simpler for Korean battery makers to maneuver extra of their provide chain to the U.S., corresponding to LG’s deliberate battery crops in partnerships with GM and Honda.

The 2021 Infrastructure Act additionally supplied $5 billion to increase charging infrastructure, which surveys present is crucial to bolstering demand.

Medium-term: Diversifying lithium and cobalt provides

A powerful and concerted effort in commerce and diplomacy is important for the U.S. to safe crucial mineral provides.

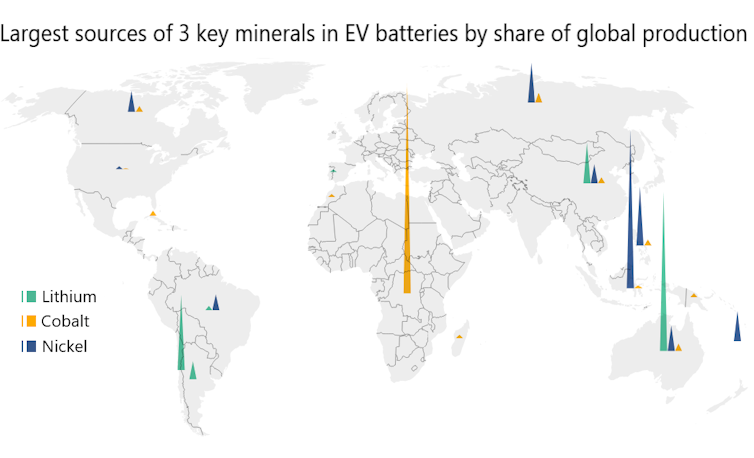

As EV gross sales rise, the world is predicted to face a lithium scarcity by 2025. Along with lithium, cobalt is required for high-performance battery chemistries.

The issue? The Democratic Republic of the Congo is the place 70% of the world’s cobalt is mined, and Chinese language corporations management 80% of that. The distant second-largest producer is Russia.

The Biden administration’s “friend-shoring” imaginative and prescient has an opportunity provided that it might probably diversify the lithium and cobalt provide chains.

The “Lithium Triangle” of South America is one area to spend money on. Additionally, Australia, a key U.S. ally, leads the world in lithium manufacturing and possesses wealthy cobalt deposits. Waste from lots of Australia’s copper mines additionally incorporates cobalt, decreasing the price. GM has reached an settlement with the Australian mining large Glencore to mine and course of cobalt in Western Australia for its Ohio battery plant with LG Chem, bypassing China.

A method to keep away from cobalt altogether additionally exists: lithium-iron-phosphate batteries are about 30% cheaper to make as a result of they use minerals which can be straightforward to seek out and plentiful. Nonetheless, LFP batteries are heavier and have much less energy and vary per unit.

For years, Chinese language corporations like CATL and BYD had been the one ones making LFP batteries. However the patent rights related to LFP batteries expire this 12 months, opening up an essential alternative for the U.S.

Since not everybody wants a high-end electrical supercar, reasonably priced EVs powered by LFP batteries are an possibility. In reality, Tesla now affords Mannequin 3s with LFP batteries that may journey about 270 miles on a cost.

The 2021 Bipartisan Infrastructure Legislation put aside $3.16 billion to assist home battery provide chains. With the Inflation Discount Act’s emphasis on supporting extra reasonably priced EVs – it has worth caps for autos to qualify for incentives – these funds will probably be wanted to assist scale up home LFP manufacturing.

Lengthy-term: US crucial mineral manufacturing

Changing abroad crucial supplies with home mining falls beneath long-term planning.

The dimensions of present home mining is minuscule, and new mining operations can take seven to 10 years to determine due to the prolonged allowing course of. Lithium deposits exist in California, Maine, Nevada and North Carolina, and there are cobalt sources in Minnesota and Idaho.

Lastly, to construct an industrial commons for EVs, the U.S. should proceed to spend money on analysis and improvement of latest battery applied sciences.

Additionally, end-of-life battery recycling is crucial to the sustainability of EVs. The business has been kicking the can down the street on this, as recycling demand has been minuscule to date given the longevity of batteries. But, as a proactive step, the Inflation Discount Act particularly permits battery content material recycled in North America to qualify for the crucial mineral clause.

To make this occur, the federal and state governments might use takeback laws much like producer duty legal guidelines for digital waste enacted in additional than 20 states, which stipulate that producers bear the duty for gathering, transporting and recycling end-of-cycle digital merchandise.

What’s forward

With the brand new legislation, the Biden administration has set its sights on a future transportation system that’s constructed within the U.S. and runs on electrical energy. However there are provide chain obstacles, and the U.S. will want each incentives and rules to make it occur.

California’s announcement will assist. Beneath the Clear Air Act, California has a waiver that enables it to set insurance policies extra strict than federal legislation. Different states can select to comply with California’s insurance policies. Seventeen different states have adopted California’s emissions requirements. Not less than three, New York, Washington and Massachusetts, have already introduced plans to additionally part out new gas-powered vehicles and light-weight vehicles by 2035.

Ho-Yin Mak, Affiliate Professor in Operations & Info Administration, Georgetown College; Christopher S. Tang, Professor of Provide Chain Administration, College of California, Los Angeles, and Tinglong Dai, Professor of Operations Administration & Enterprise Analytics, Carey Enterprise Faculty, Johns Hopkins College

This text is republished from The Dialog beneath a Artistic Commons license. Learn the unique article.

[ad_2]

Supply hyperlink